Does Hawaii Have State Tax

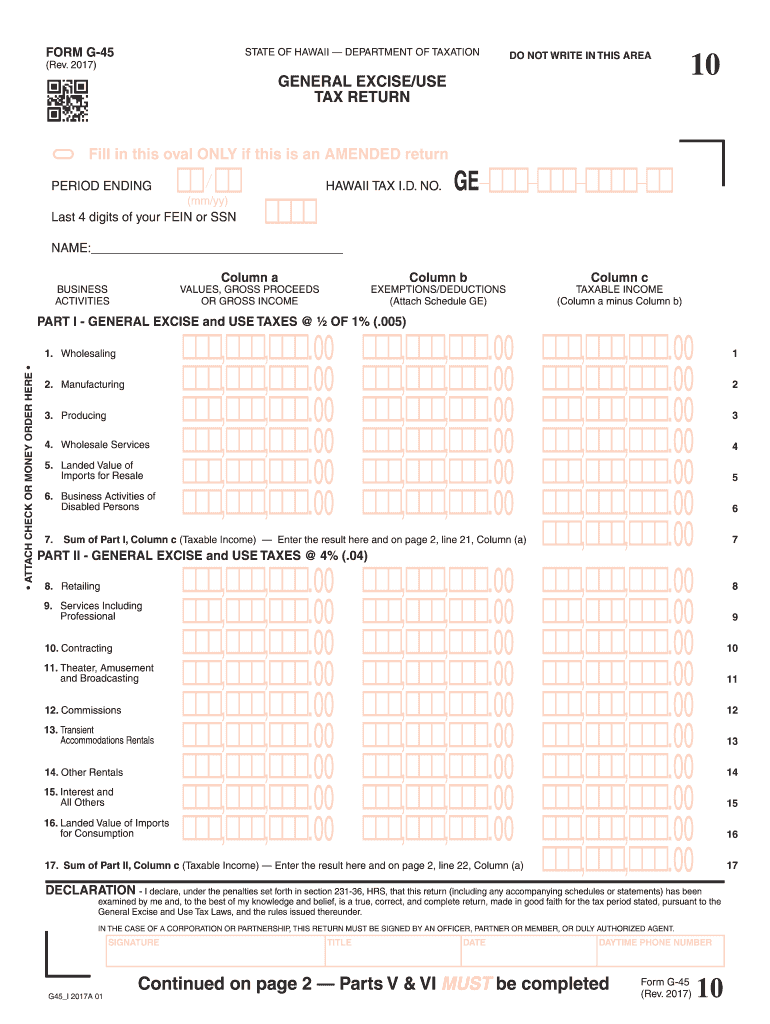

The state of hawaii does collect their general excise tax when it comes to certain services.

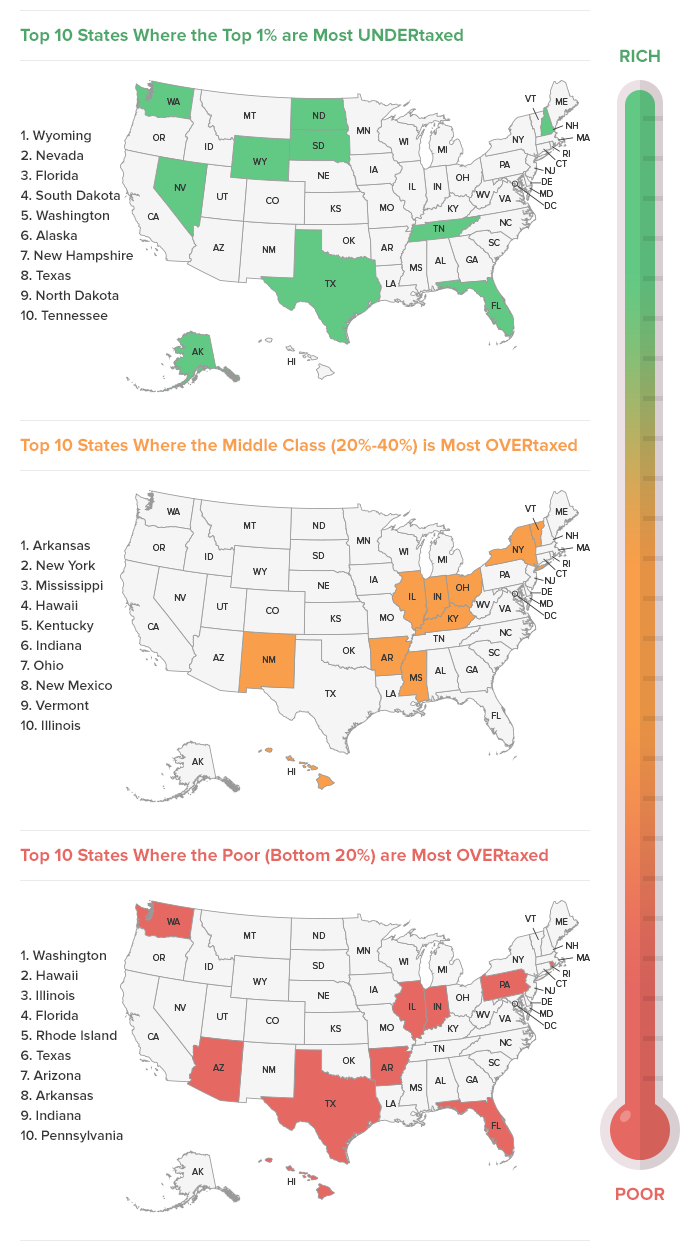

Does hawaii have state tax. Hawaii entirely exempts some types of retirement income including social security retirement benefits and public pension income but fully taxes income from private pensions and retirement savings accounts. The good news is that public pension income is totally tax exempt in hawaiithe bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction. You can find a table describing the taxability of common types of services later on this page.

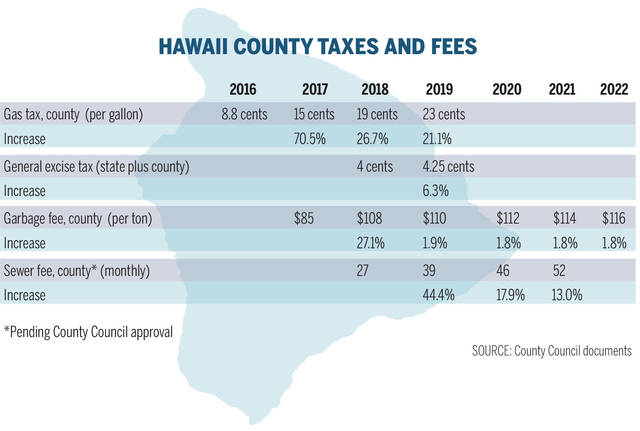

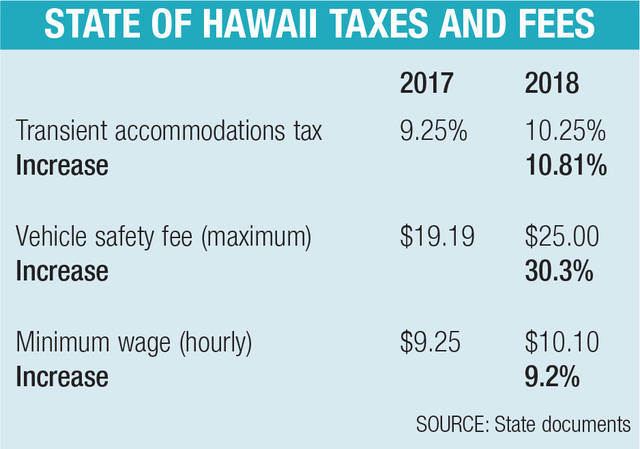

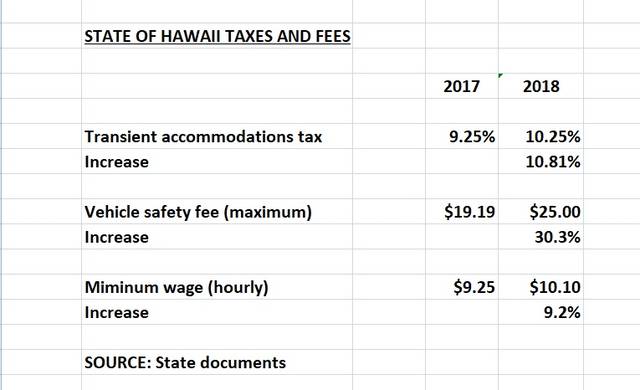

Instead the state collects a 4 general excise tax which is assessed on all business activities including retail sales commissions rental income and services. That number is expected to rise to the federal exemption level in 2019 though specifics have yet to be determined. The tax will apply to the estates of residents and nonresidents who own real estate andor tangible personal property located in hawaii.

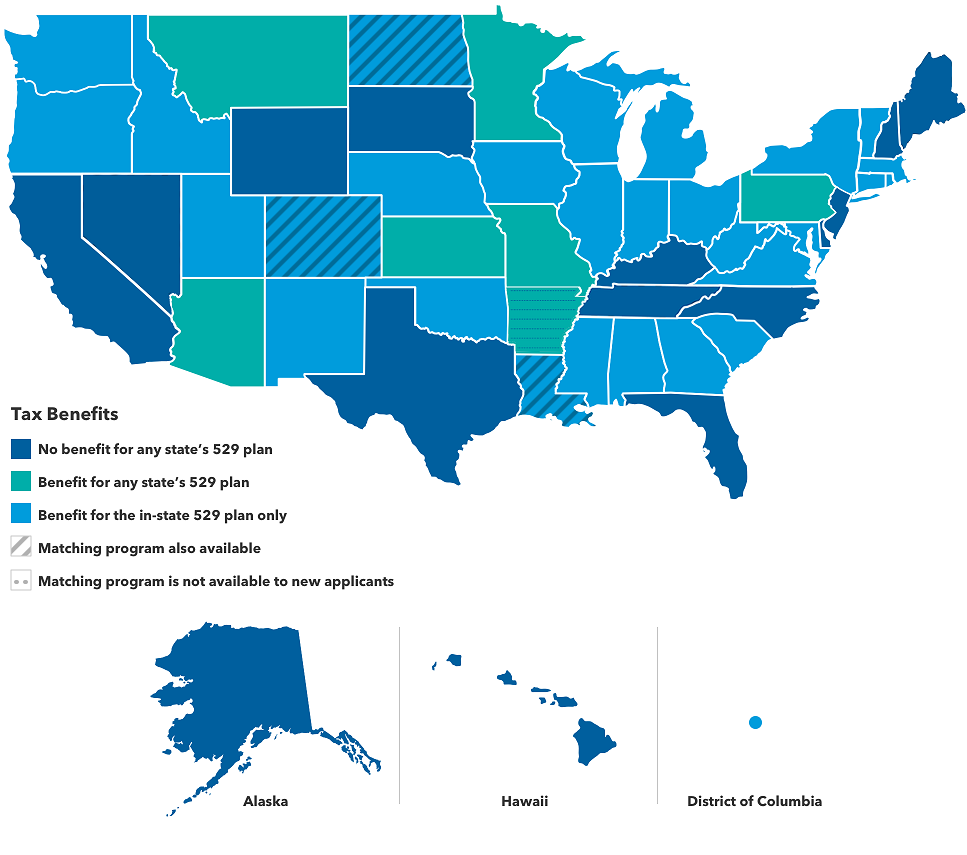

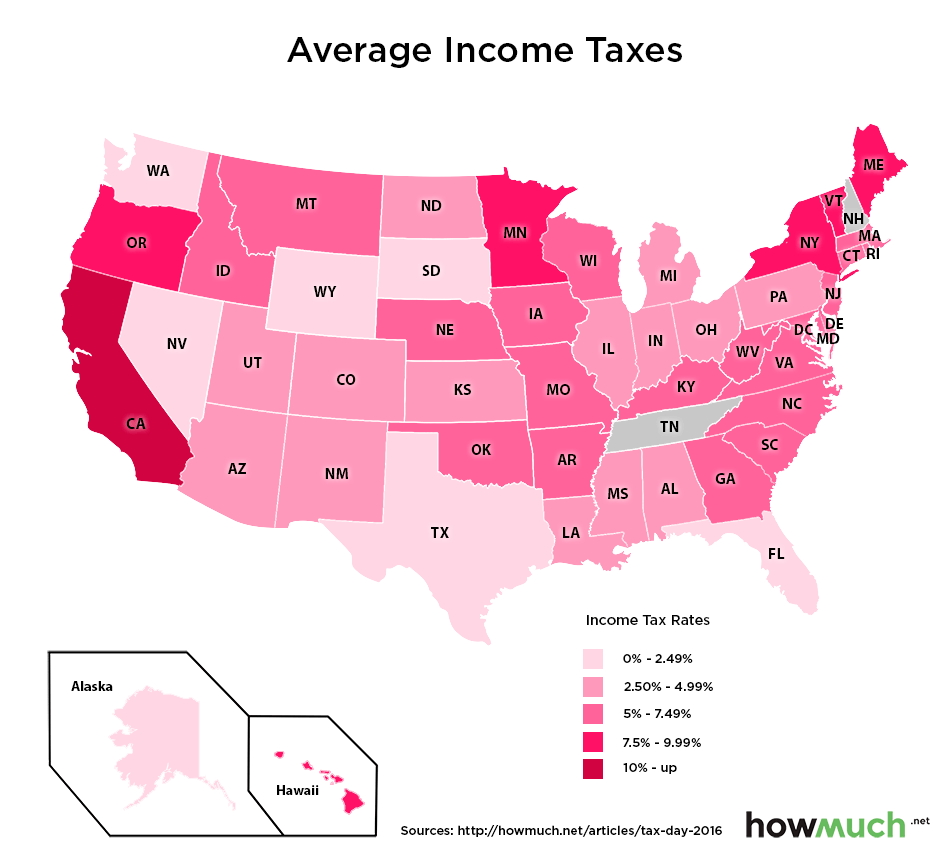

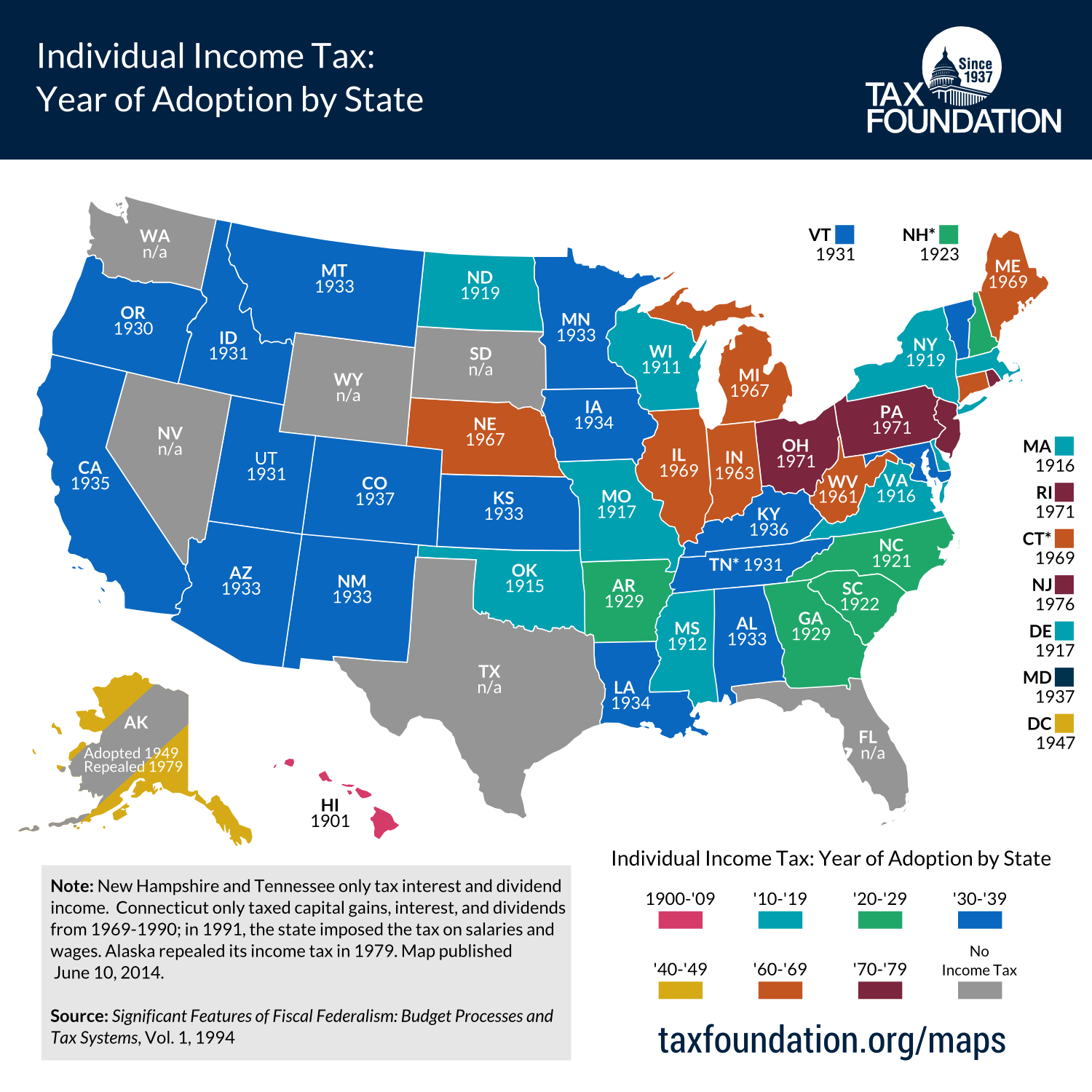

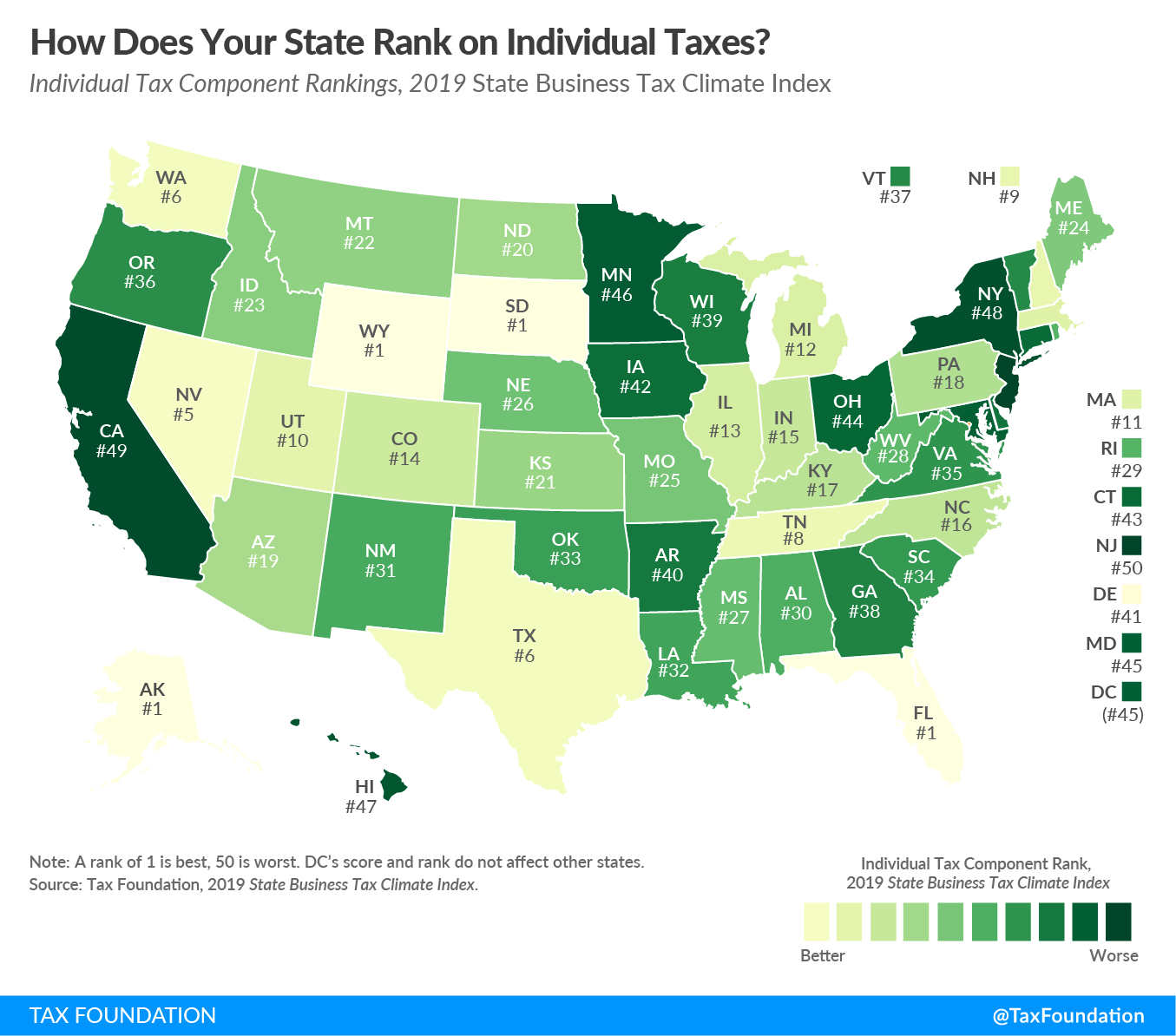

The excise tax is 4 with some counties charging an additional 05. The hawaii income tax hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. For 2018 the estate tax exemption in hawaii is 549 million.

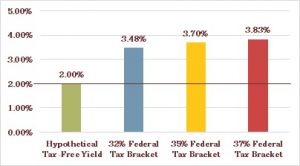

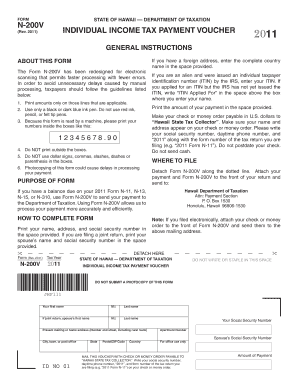

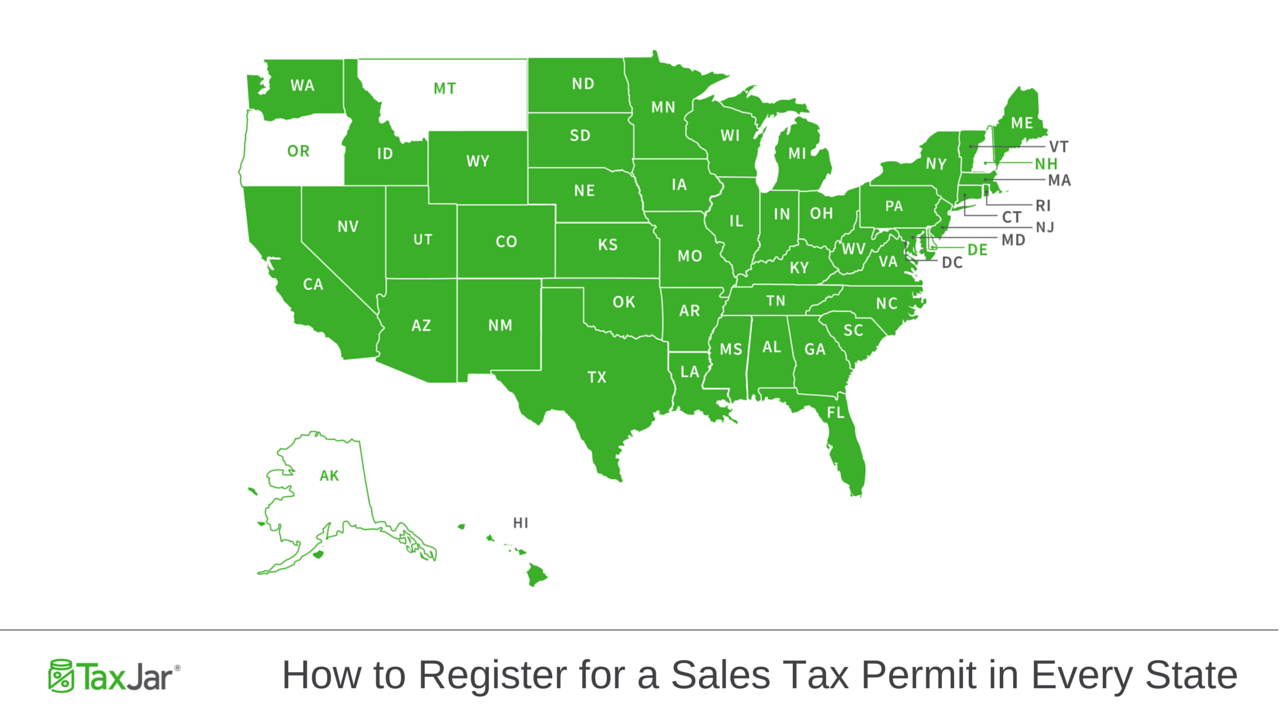

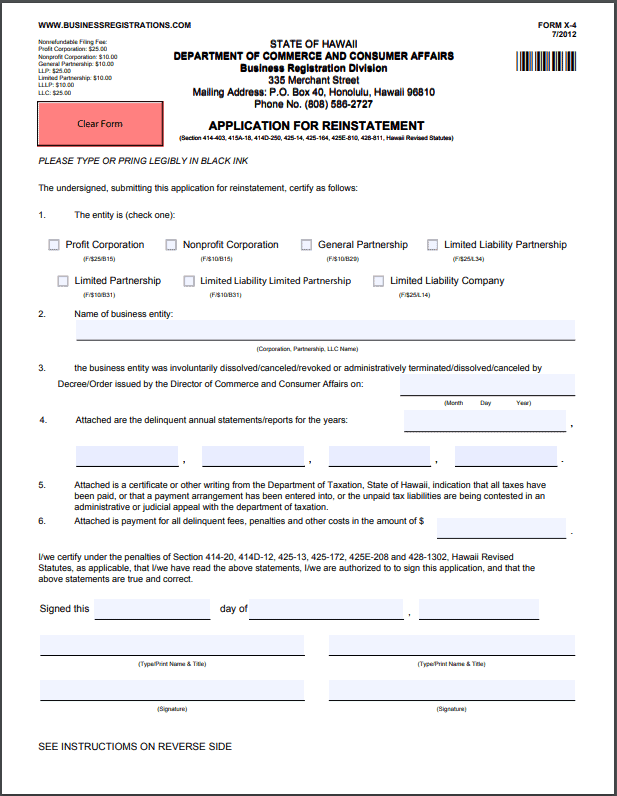

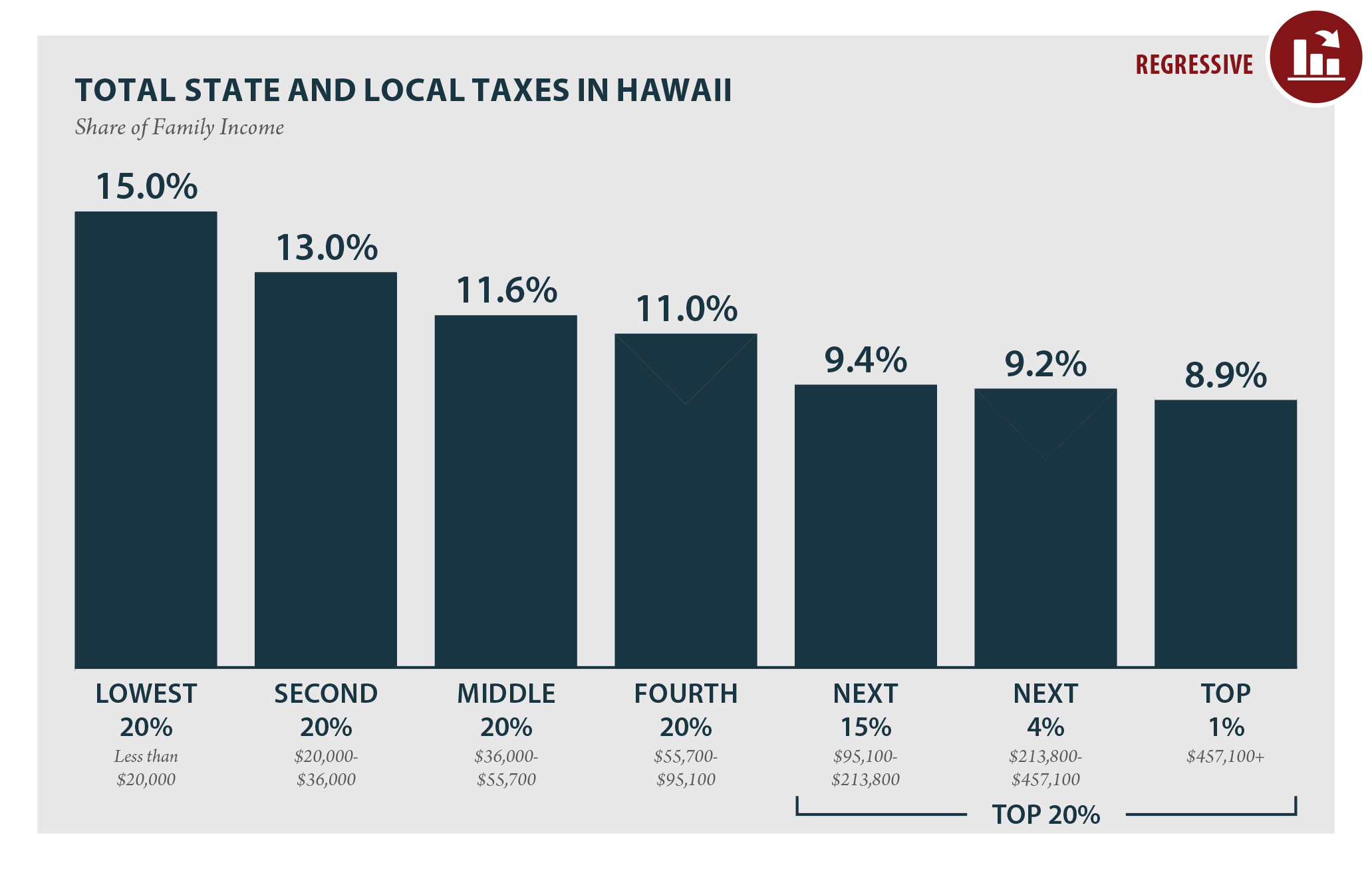

The department of taxation department maintains a voluntary disclosure process as an informal practice allowing taxpayers to voluntarily disclose any liability for all hawaii taxes including general excise tax transient accommodations tax corporate net income tax and individual net income tax. The tax is progressive with rates ranging from 1000 to 1570. While hawaii doesnt technically have a state sales tax there is a general excise tax that businesses pay on all business activities.

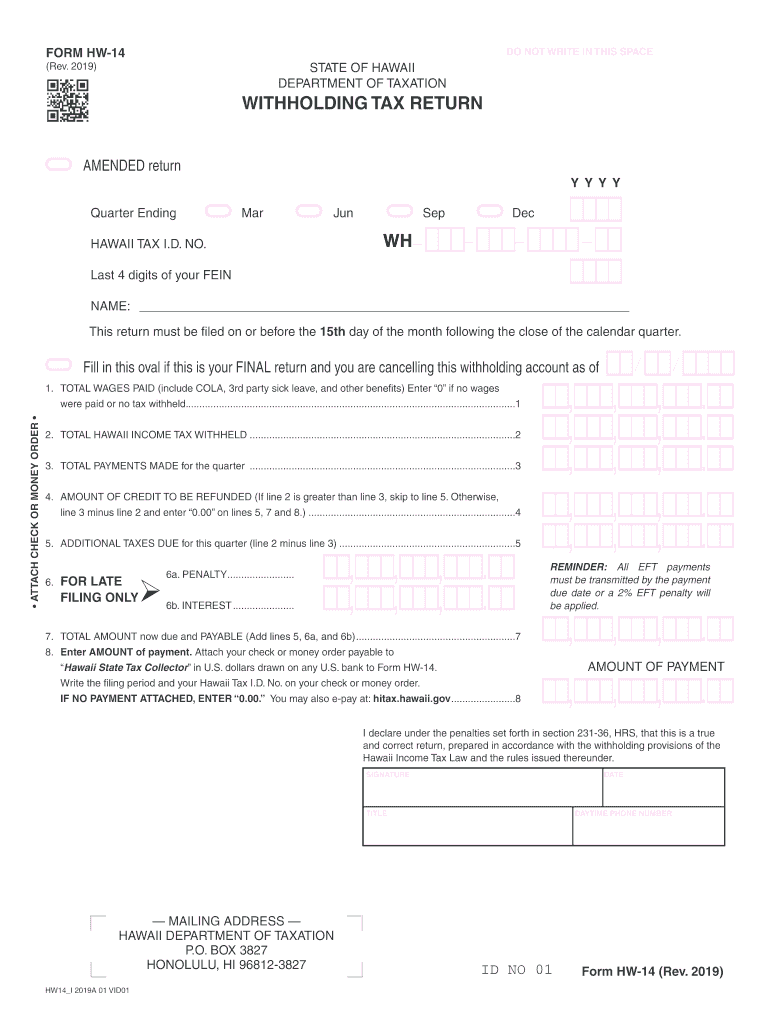

Hawaii levies an estate tax. This tir supersedes tir no. Hawaii tax online currently supports general excise transient accommodations withholding use only sellers collection corporate income franchise rental motor vehicle county surcharge and public service company taxes.

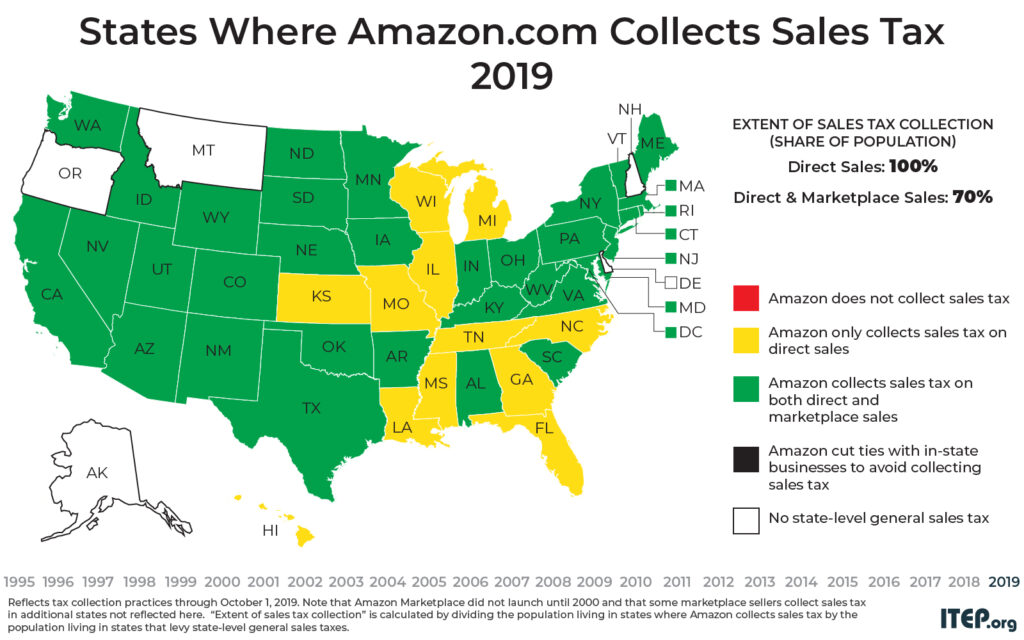

This tax is usually passed on to consumers. Hawaii does not have a sales tax. The hawaii state sales tax rate is 4 and the average hi sales tax after local surtaxes is 435.

Beginning november 13 it will also support individual income partnership estatetransfer and fiduciary tax types.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrdu3th O0t4u2qywjsyyoeq7ckyujvgzochendydgoexek Ljg Usqp Cau

encrypted-tbn0.gstatic.com

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

/kona-airport-59e66019b501e80011ccbd50.jpg)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

.png)