Hawaii Online Tax Payments

Most questions can best be resolved by contacting the state agency directly.

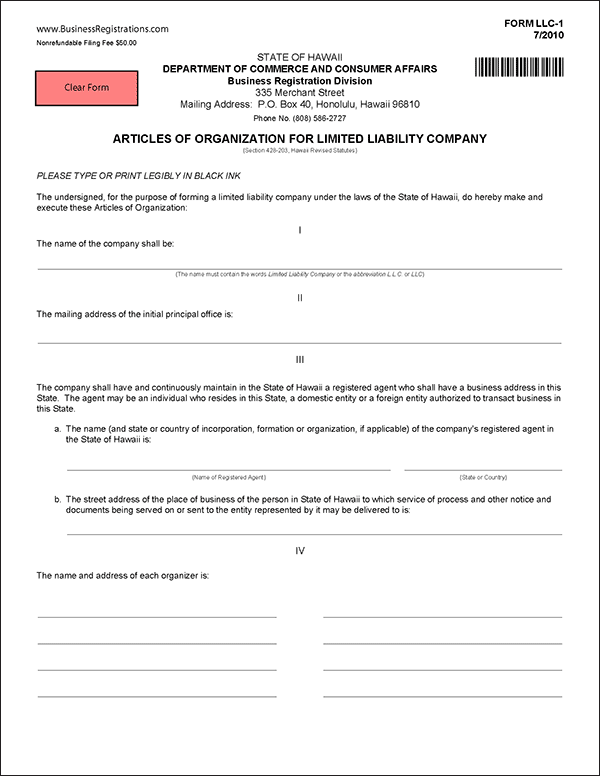

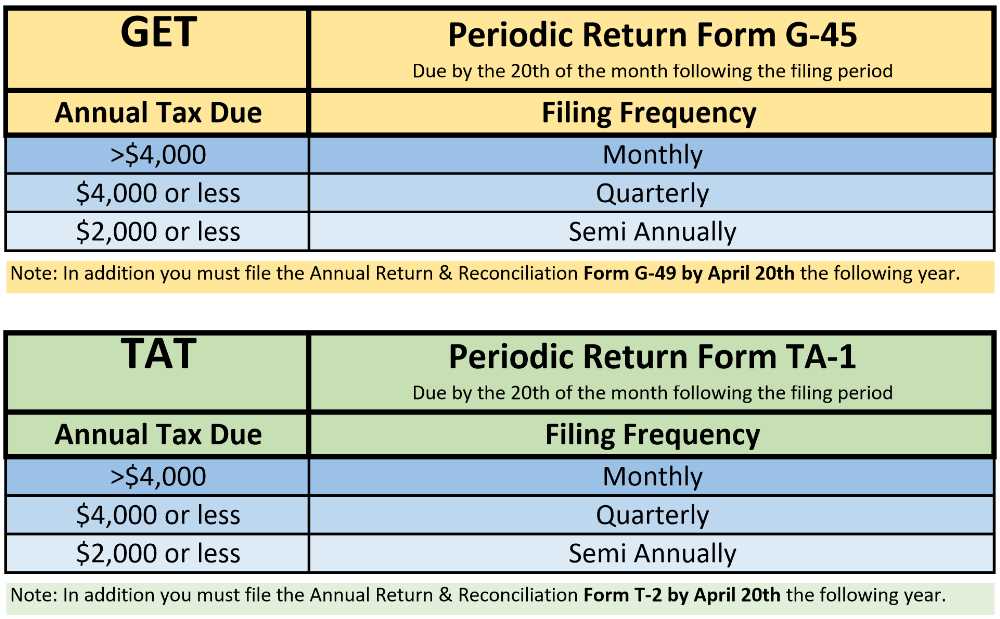

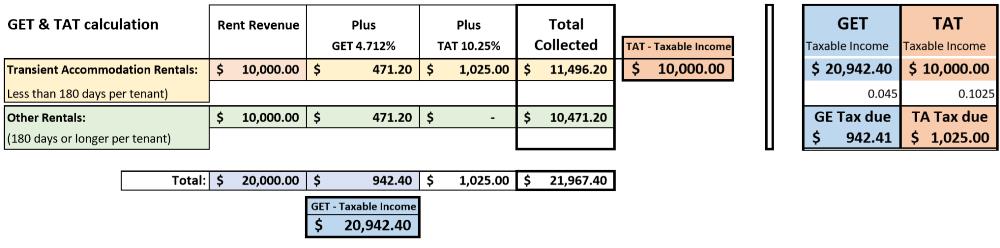

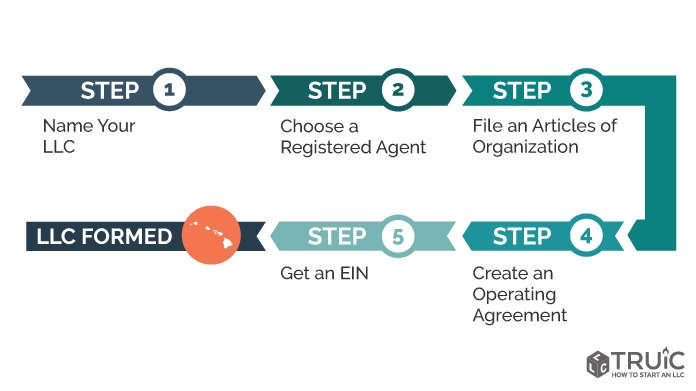

Hawaii online tax payments. Tax clearance certificatesa tax clearance certificate is issued by the department of taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of hawaii title 14 hawaii revised statutes. Hawaii does not have a sales tax. Instead we have the get which is assessed on all business activities.

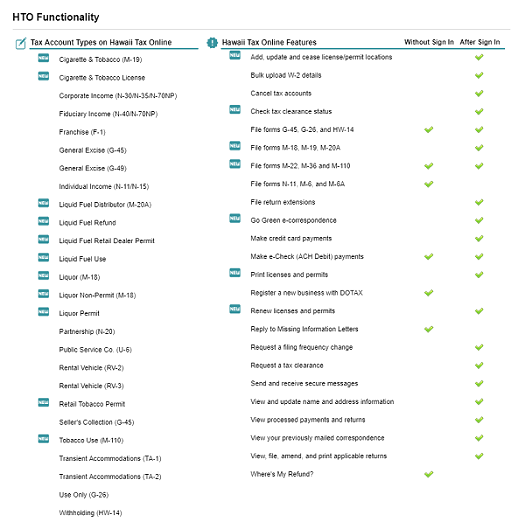

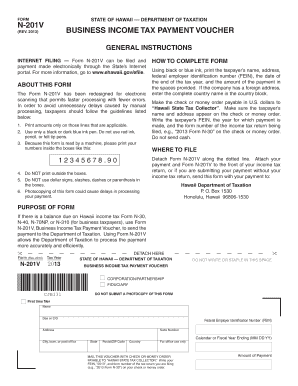

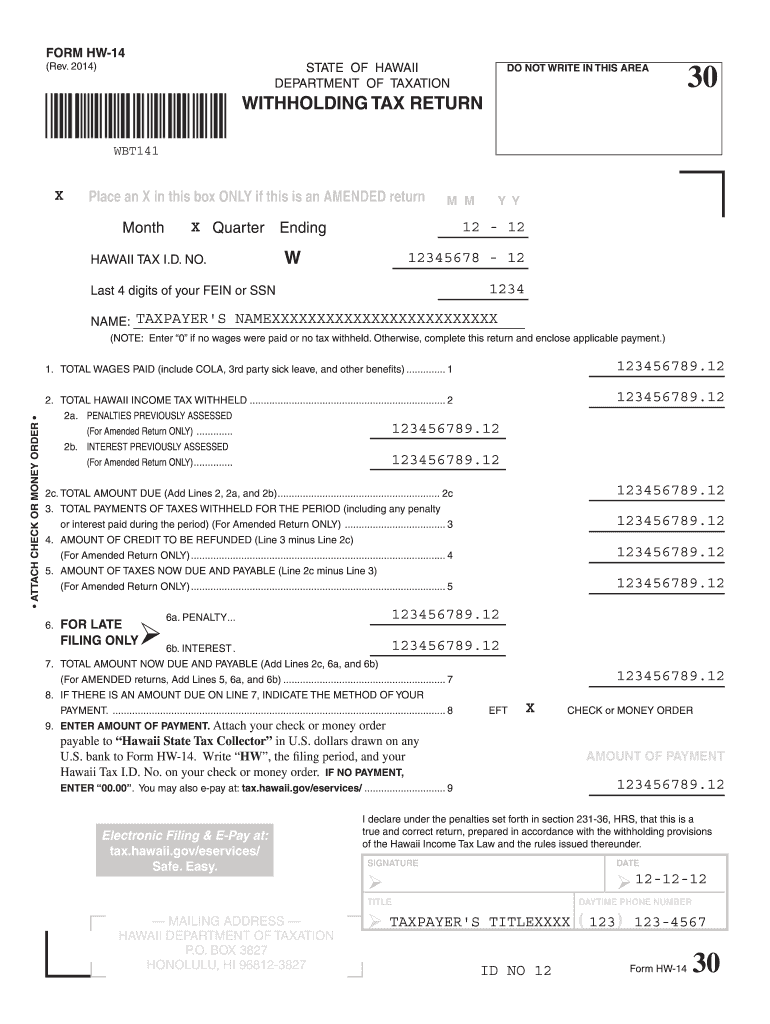

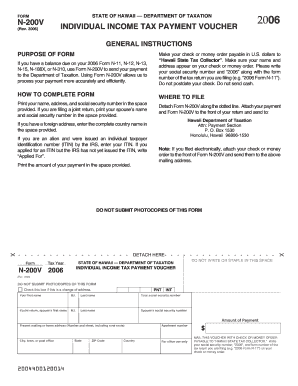

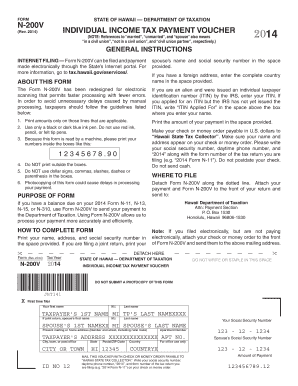

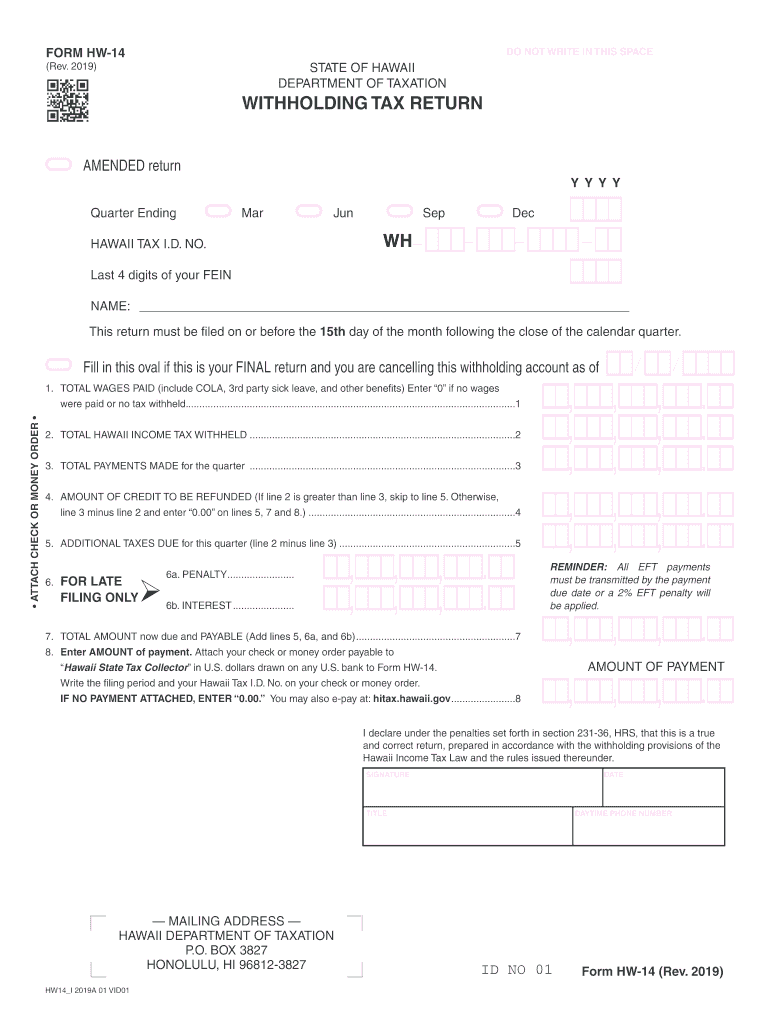

Most widely used return forms are available for e filing on hto. Elf dotaxehawaiigov hawaii business express hbe hawaii compliance express hce irs modernized e file program. Pinless debit card 100 100 minimum for online payments only to pay with credit card via telephone call toll free at 1 877 309 9117.

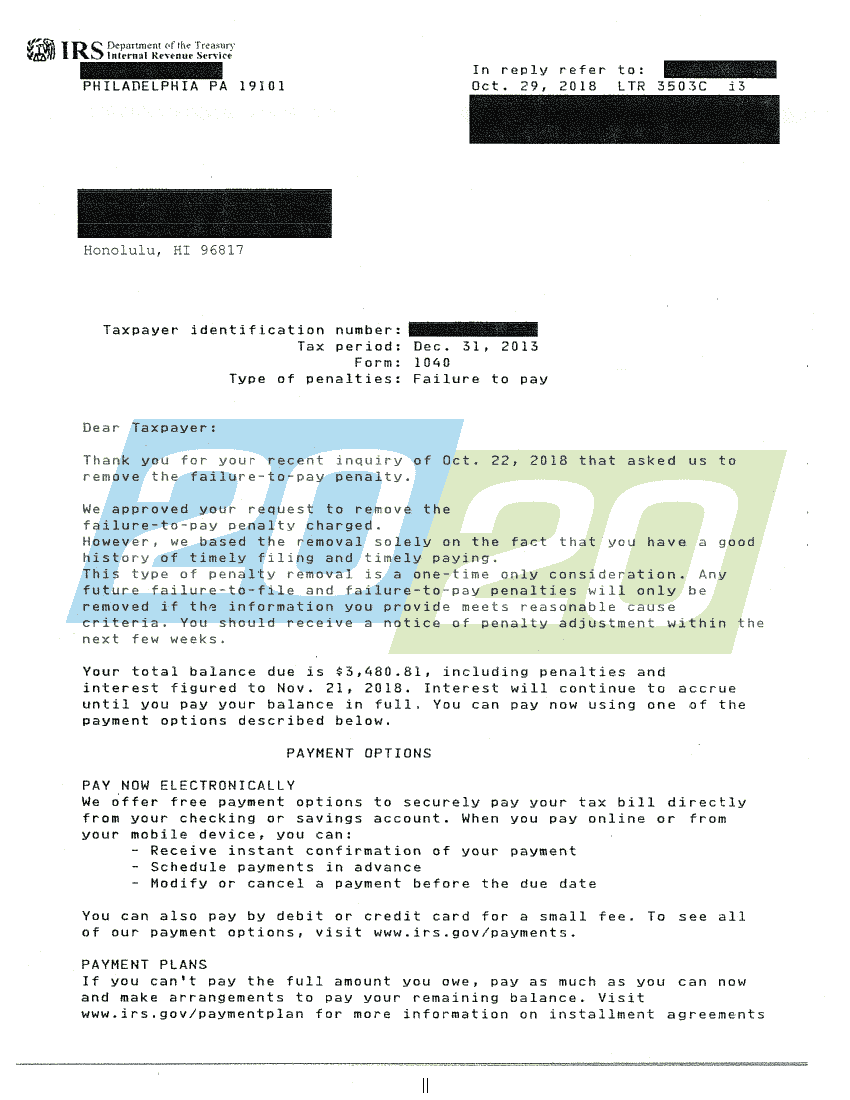

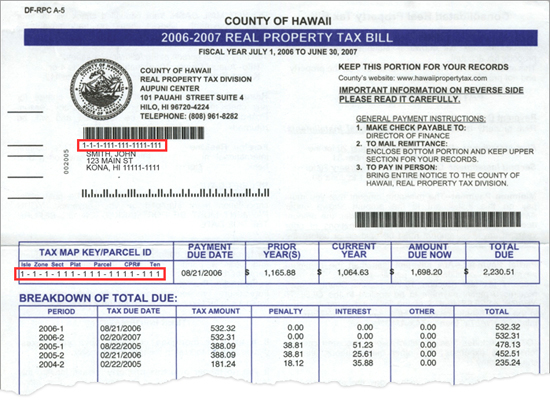

You must pay the amount due now by the due date to avoid additional penalty and interest charges. 808 323 4880 or email. This means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all.

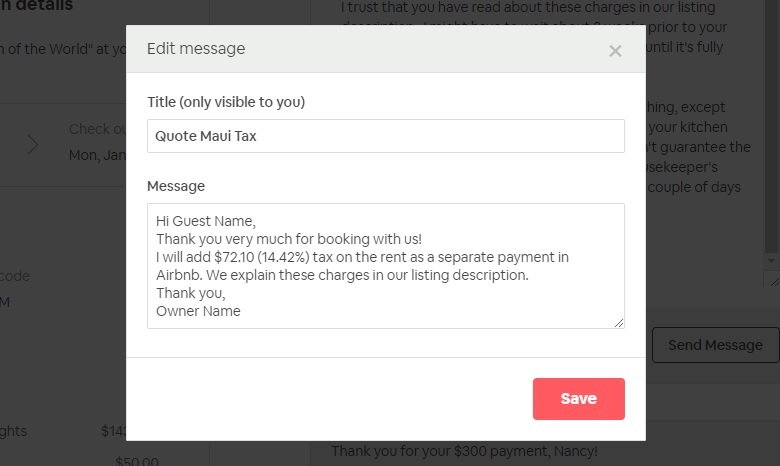

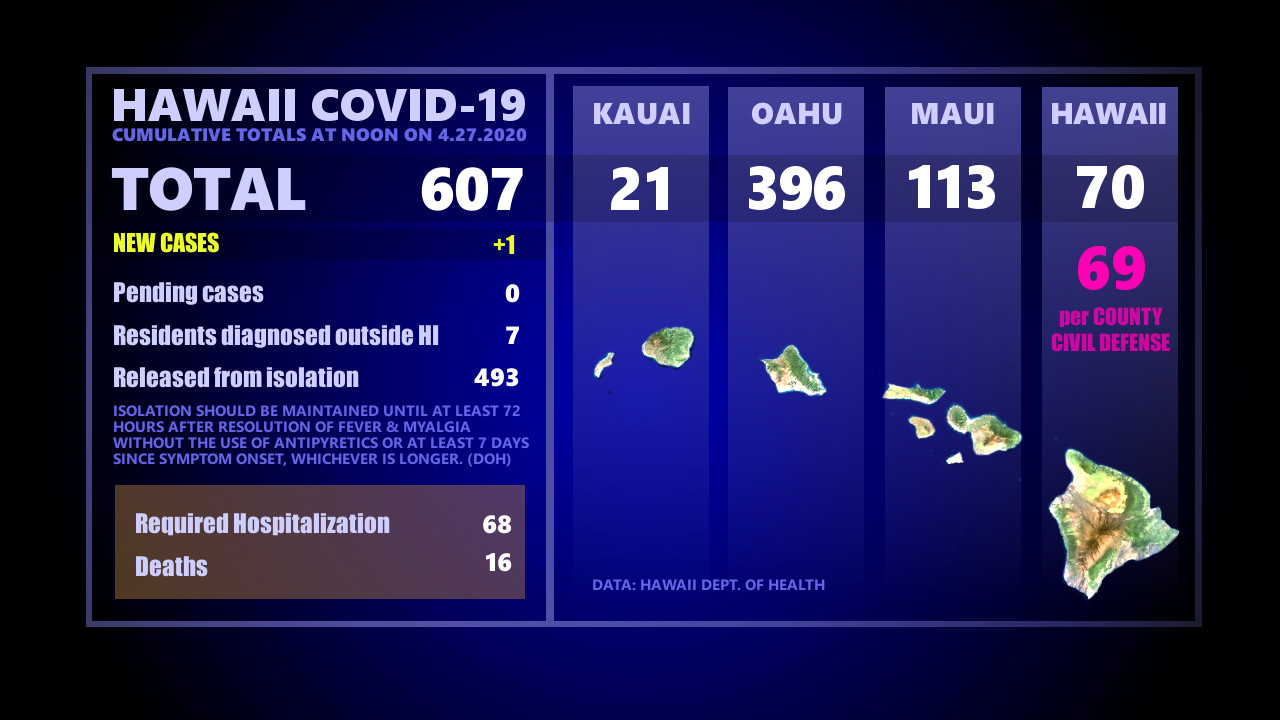

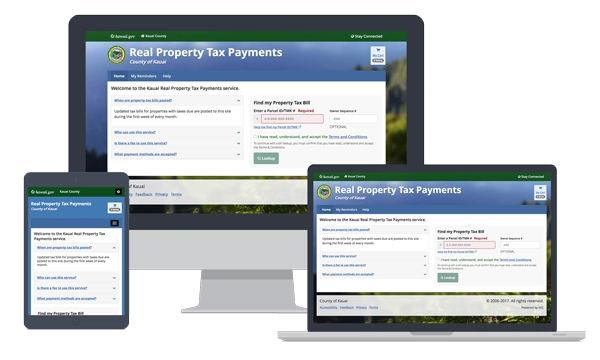

Real estate continuing education system check your continuing education status online. County of maui pay your real property tax bill for property in the county of maui. We will accept the amount due now or new balance that is shown on your tax bill.

E filed returns are easier to complete more accurate and processed more quickly than paper returns. The tax rate is 015 for insurance commission 05 for wholesaling manufacturing producing wholesale services and use tax on imports for resale and 4 for all others. Thank you for using county of hawaiis online payment service.

Payments and returns can be made on hawaii tax online hto. Help ask the agency. Hawaii tax online hto hawaii tax online is the convenient and secure way to e file tax returns make payments review letters manage your.

The fee will be disclosed to you when you confirm the payment. Online real property tax payments. The fee for a payment made with a credit card will be displayed before you confirm your payment.

Service fees associated with online payments will be passed on to you in the form of an additional fee by the online vendor.

.png)