Hawaii State Income Tax Rate

Health labor faqs human services inter island travel form transpacific travel form recovery navigator.

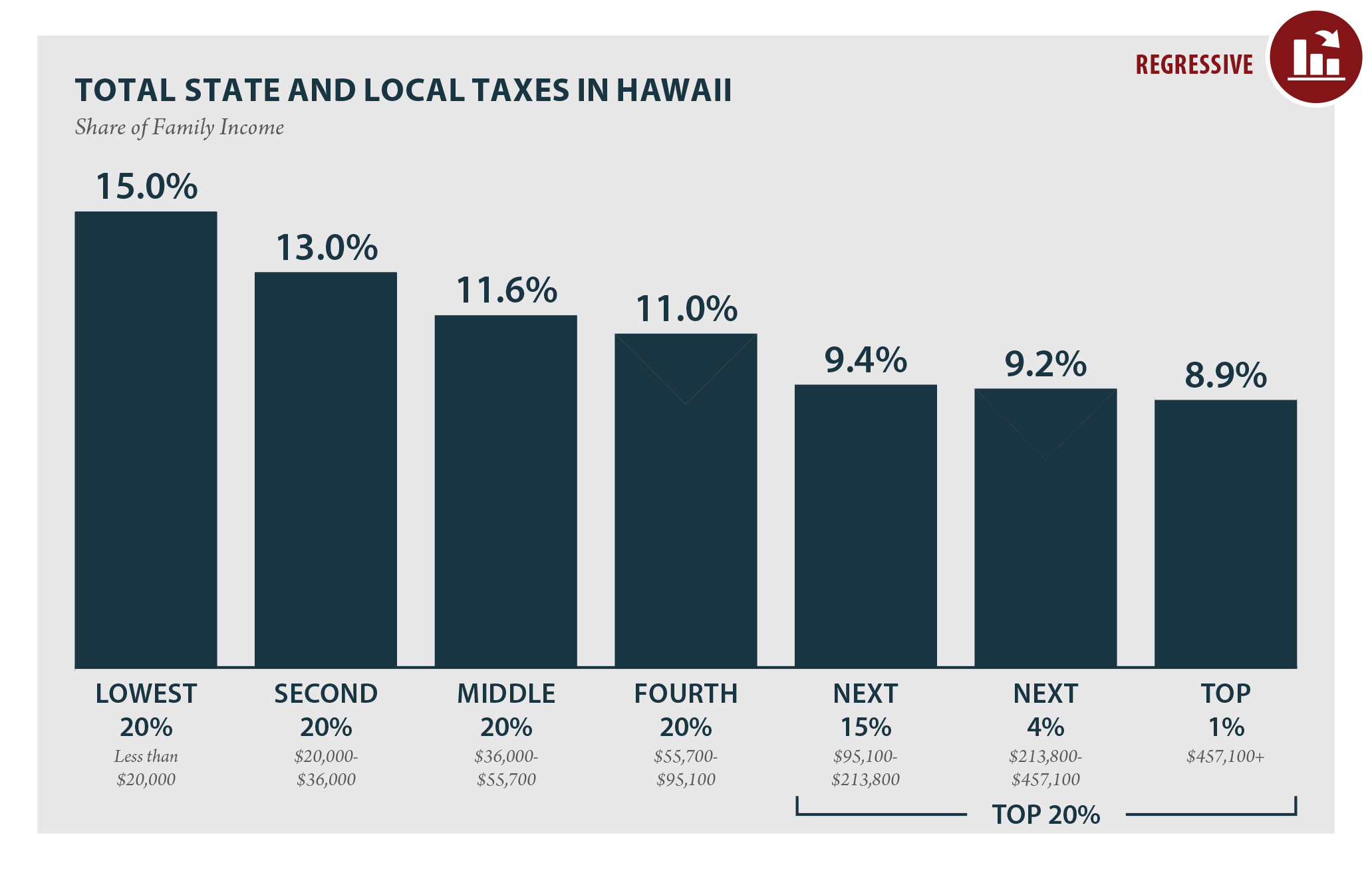

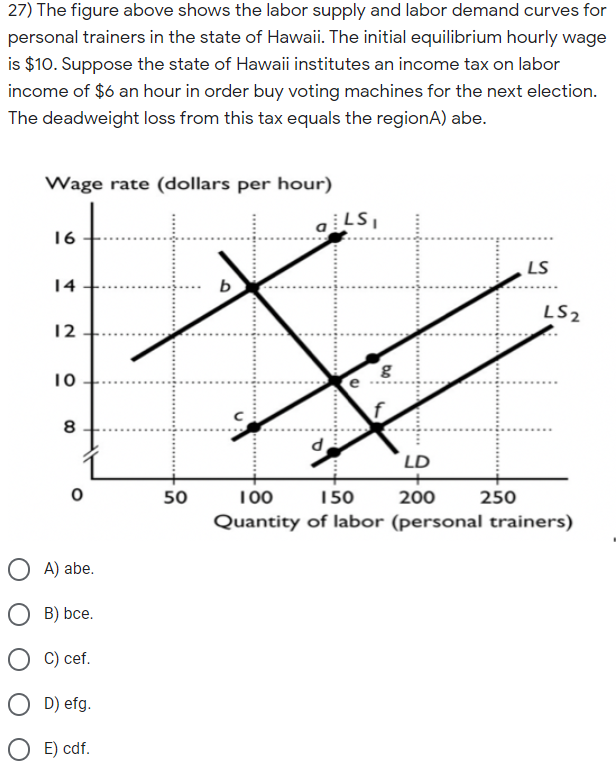

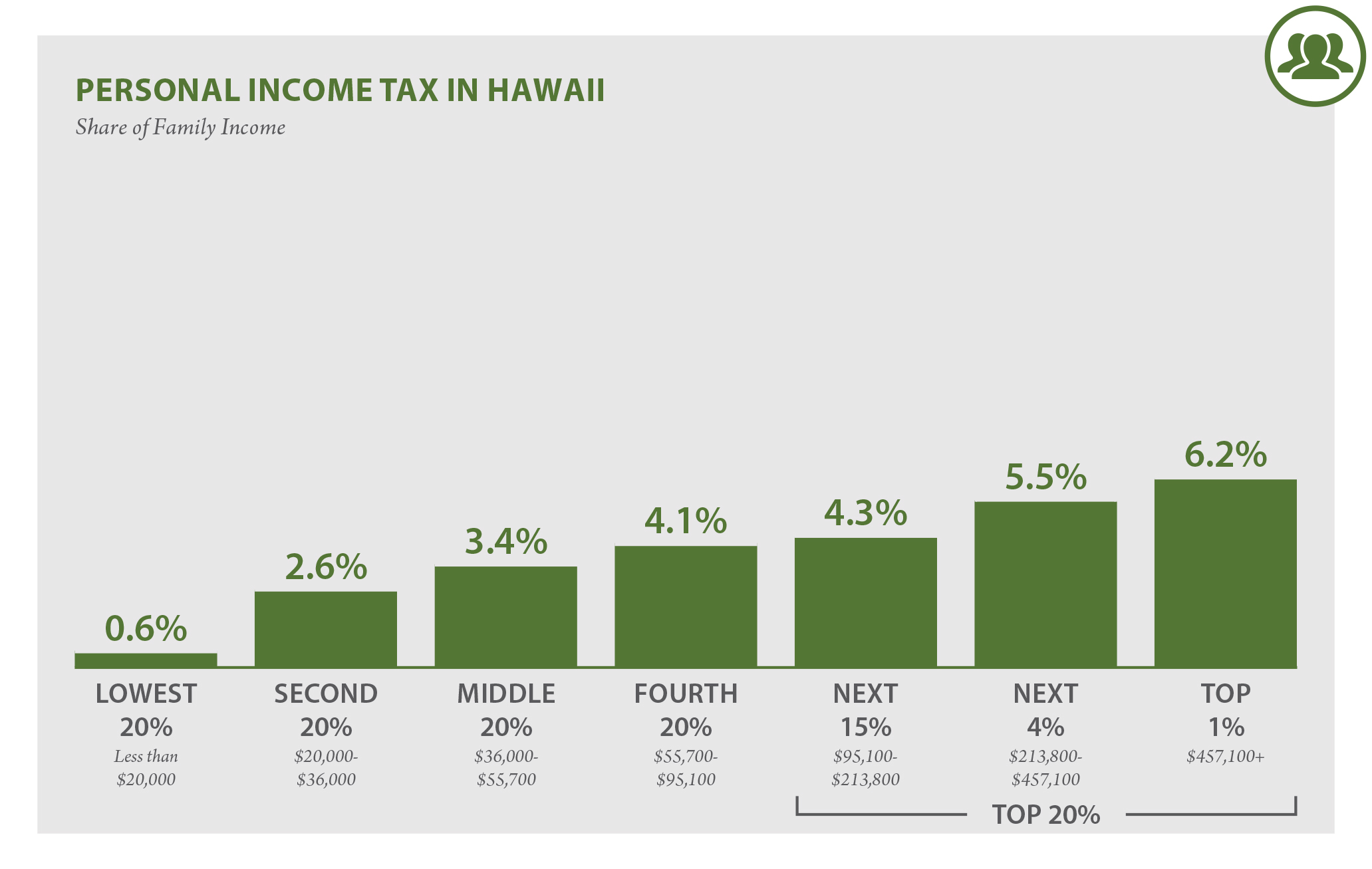

Hawaii state income tax rate. The most significant tax in the state is the personal income tax. If the amount on form n 11 line 26 is. 140 of taxable income.

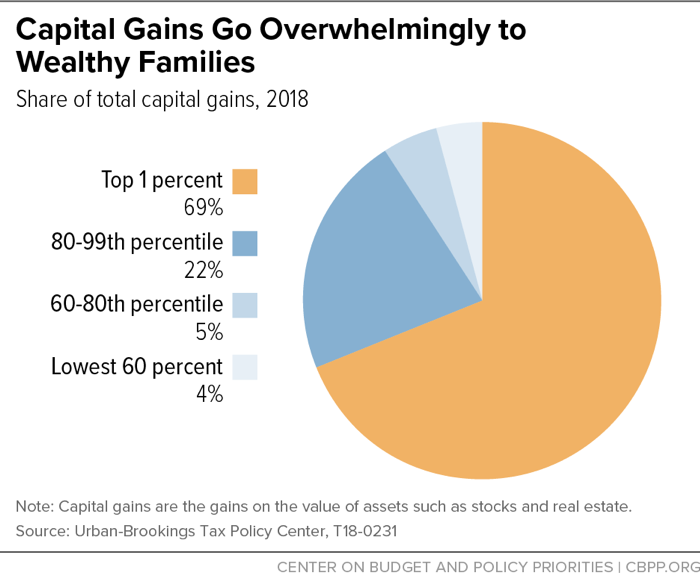

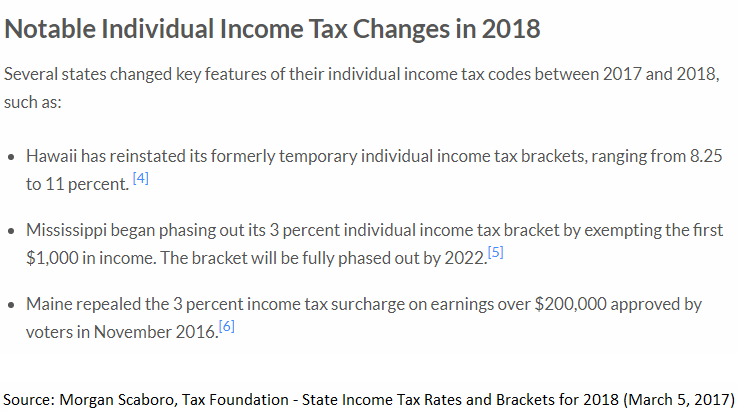

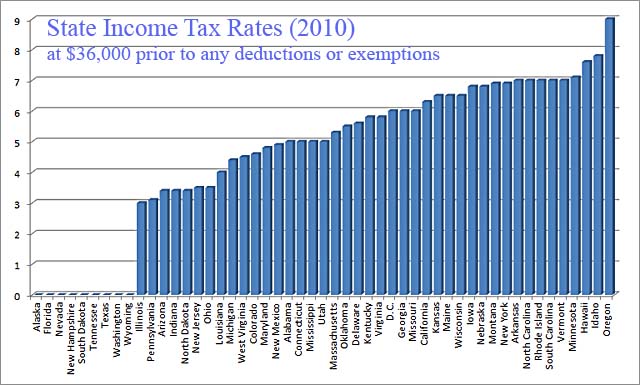

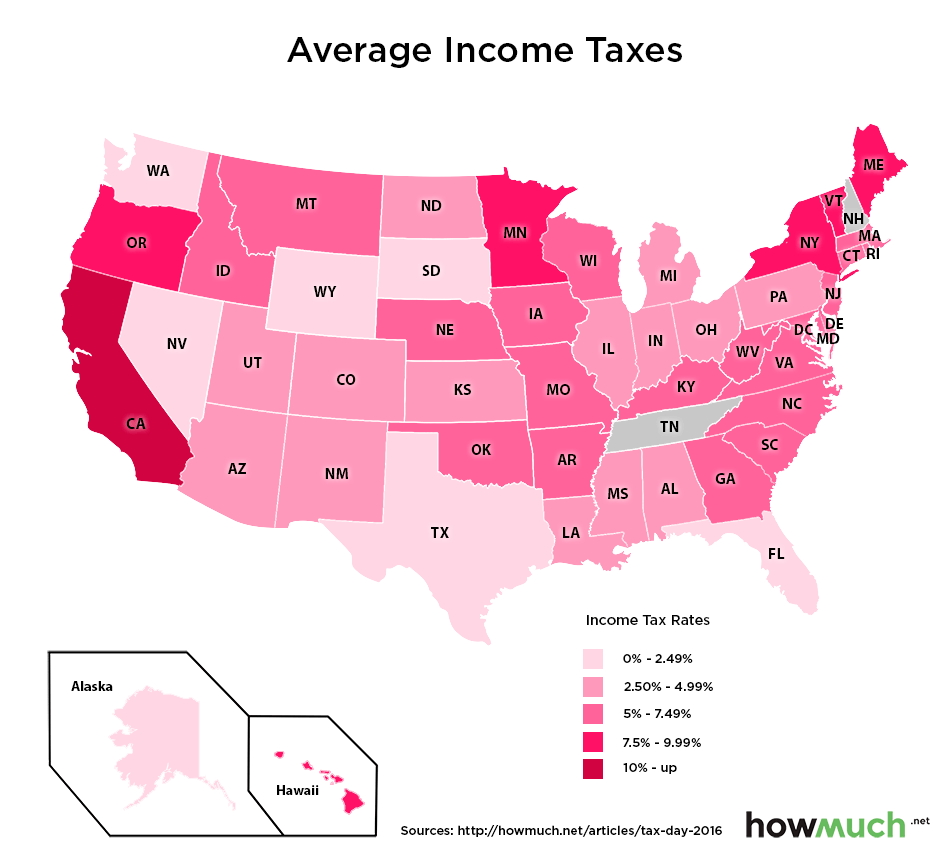

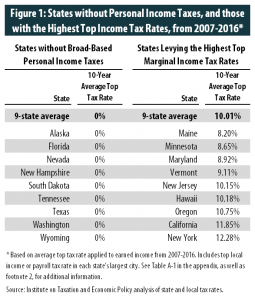

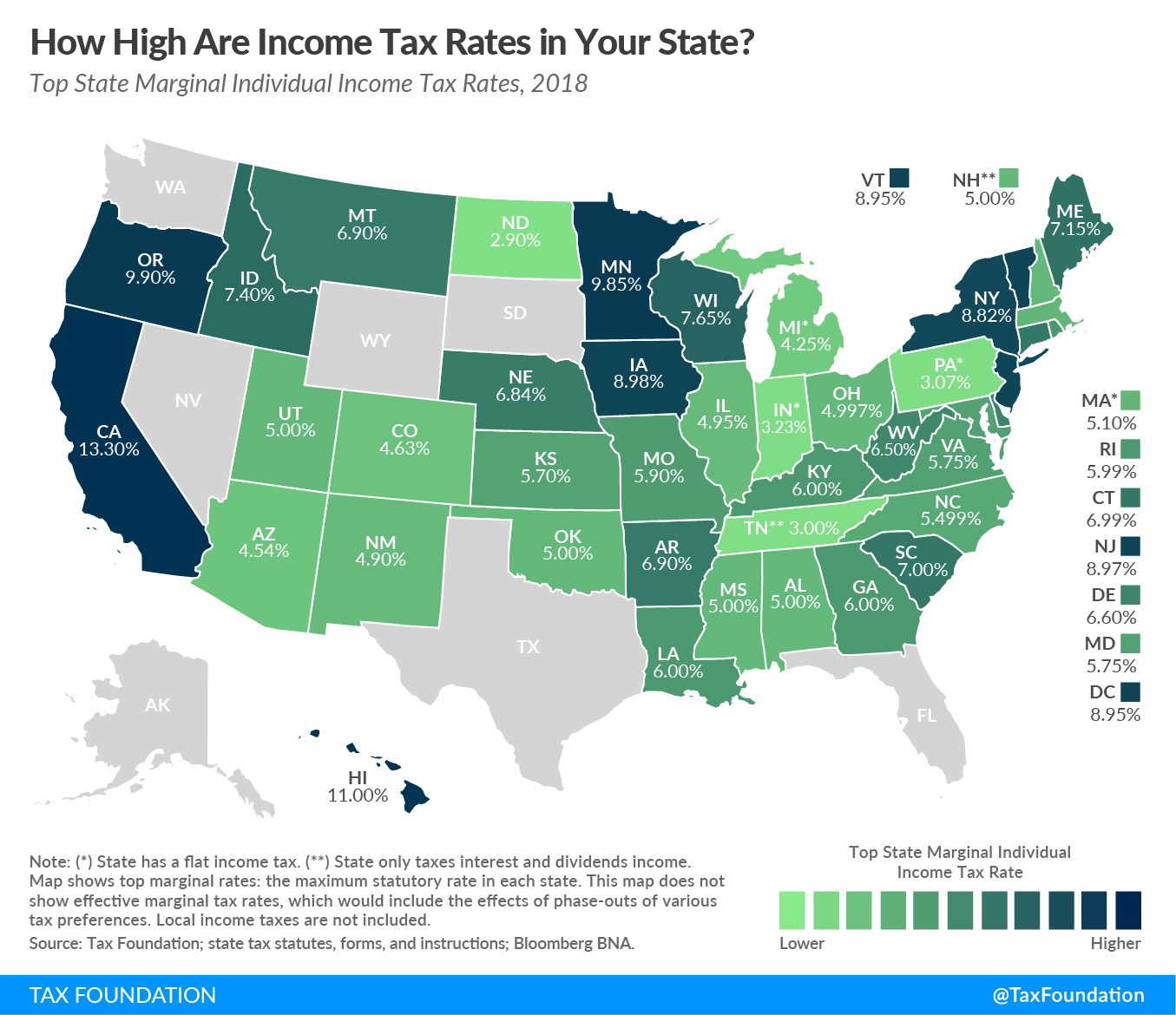

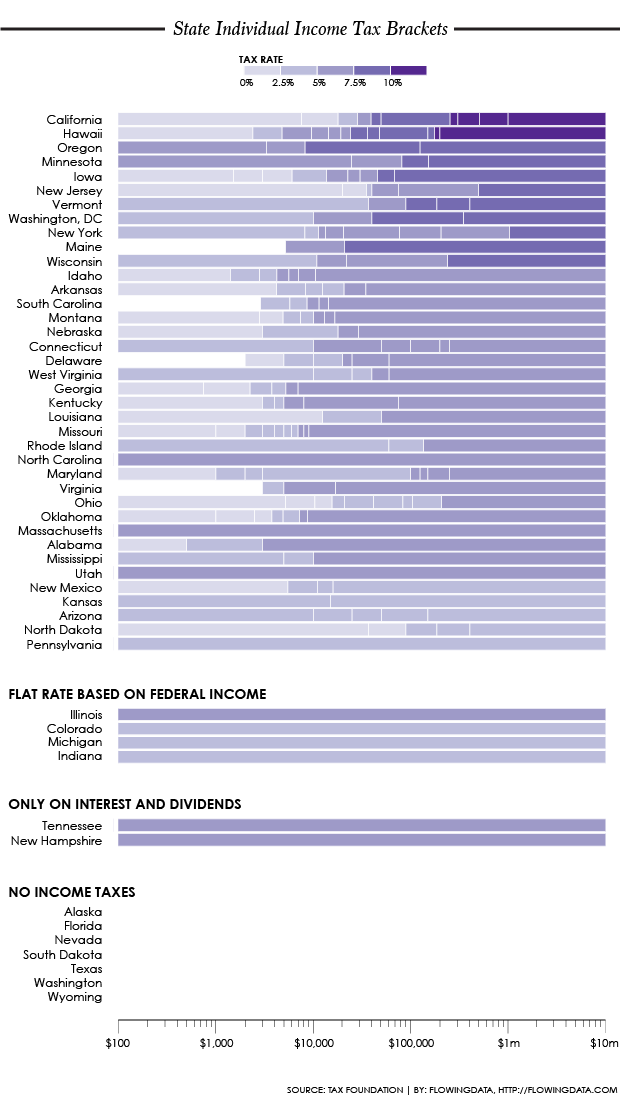

Schedule i single taxpayers and married filing separate returns use this schedule if you checked filing status oval 1 or 3 on form n 11. Hawaii state income tax rate table for the 2019 2020 filing season has twelve income tax brackets with hi tax rates of 14 32 55 64 68 72 76 79 825 9 10 and 11 for single married filing jointly married filing separately and head of household statuses. Hawaii has twelve marginal tax brackets ranging from 14 the lowest hawaii tax bracket to 11 the highest hawaii tax bracket.

2019 tax rate schedule i single and married filing separate. 34 plus 320. Hawaii state income tax table all data extracted from instructions booklet.

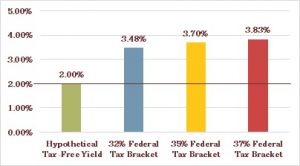

Hawaii collects income taxes from its residents at the following rates. This tir supersedes tir no. Hawaii income tax rates hawaii has a progressive tax with 12 tax brackets and rates based on your taxable income and filing status which can make it complicated when calculating your tax liability.

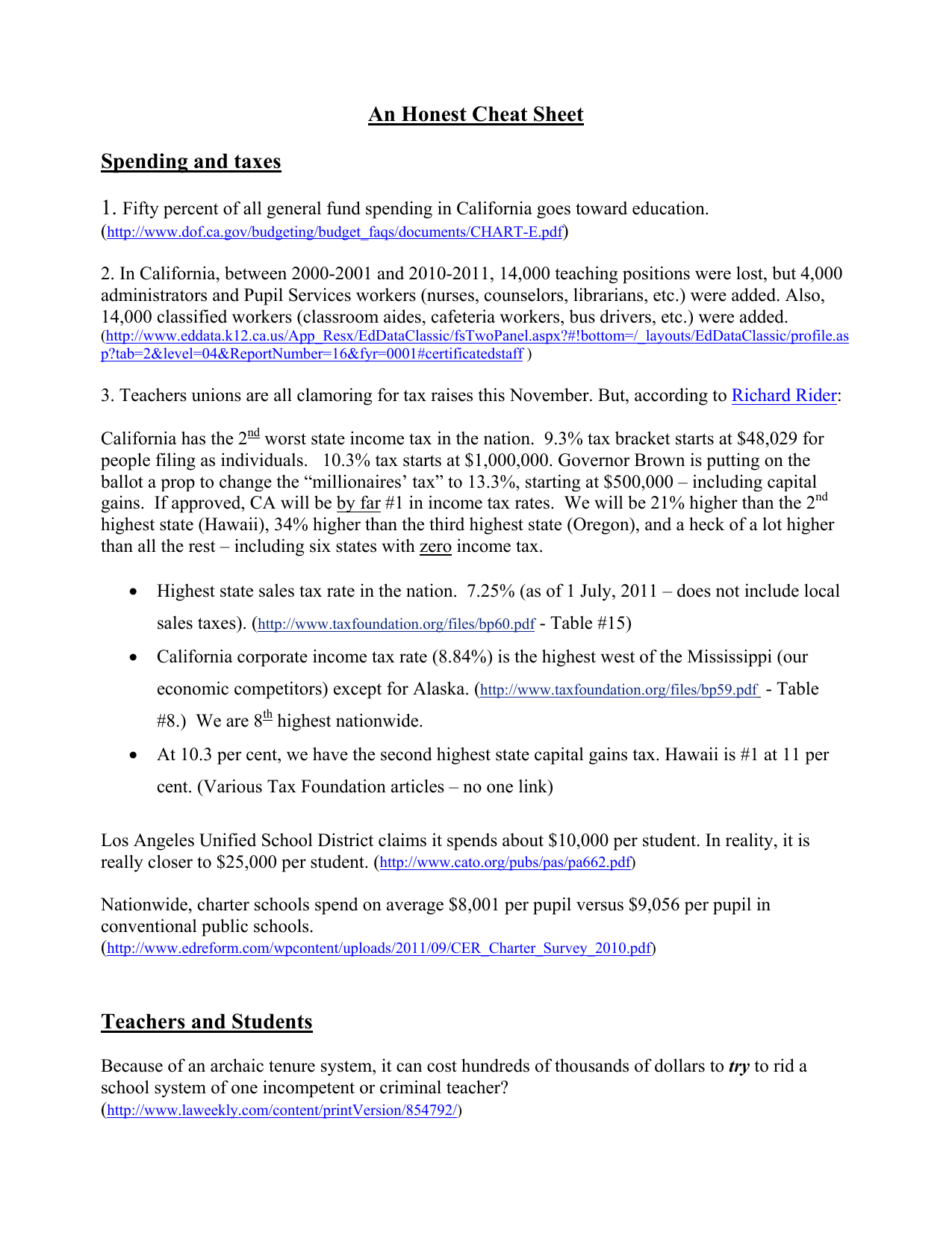

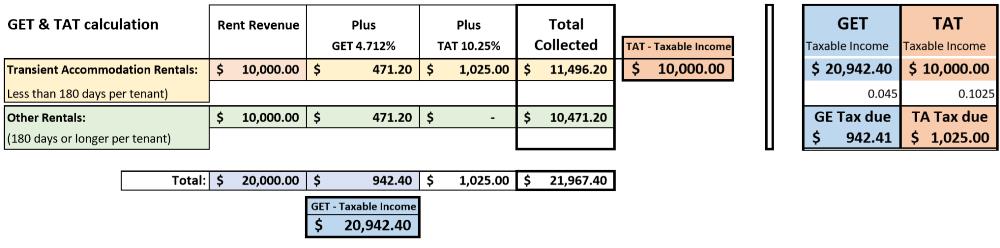

The 2018 tax rates range from 14 to 11 for the highest tax bracket. The department of taxation department maintains a voluntary disclosure process as an informal practice allowing taxpayers to voluntarily disclose any liability for all hawaii taxes including general excise tax transient accommodations tax corporate net income tax and individual net income tax. Over 2400 but not over 4800.

The hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2020. Hawaii income tax rate 2019 2020. Income earners living on the hawaiian islands pay tax rates between 140 and 11 depending on their income level.

Detailed hawaii state income tax rates and brackets are available on this page. Links to 2019 individual tax tables and rate schedules 2019 tax table pdf file of entire table 14 pages 355 kb covid 19 related information. If youre thinking about a move to the aloha state youll want to know how the states tax system affects your finances.

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)