Property Tax Hawaii Maui

All Hawaii News Hawaii Gop Gears Up For Caucuses In Wake Of Trump Win Ellison Omidyar On Forbes Fortune List Mayors Caldwell Kenoi Release Workaday Budgets Maui Farmers Oppose Property Tax Measure

www.allhawaiinews.com

Aloha and welcome to the county of hawaii s real property tax assessment website the hawaii real property tax website was designed to provide quick and easy access to real property tax assessment records and maps for properties located in the county of hawaii and related general information about real property tax procedures.

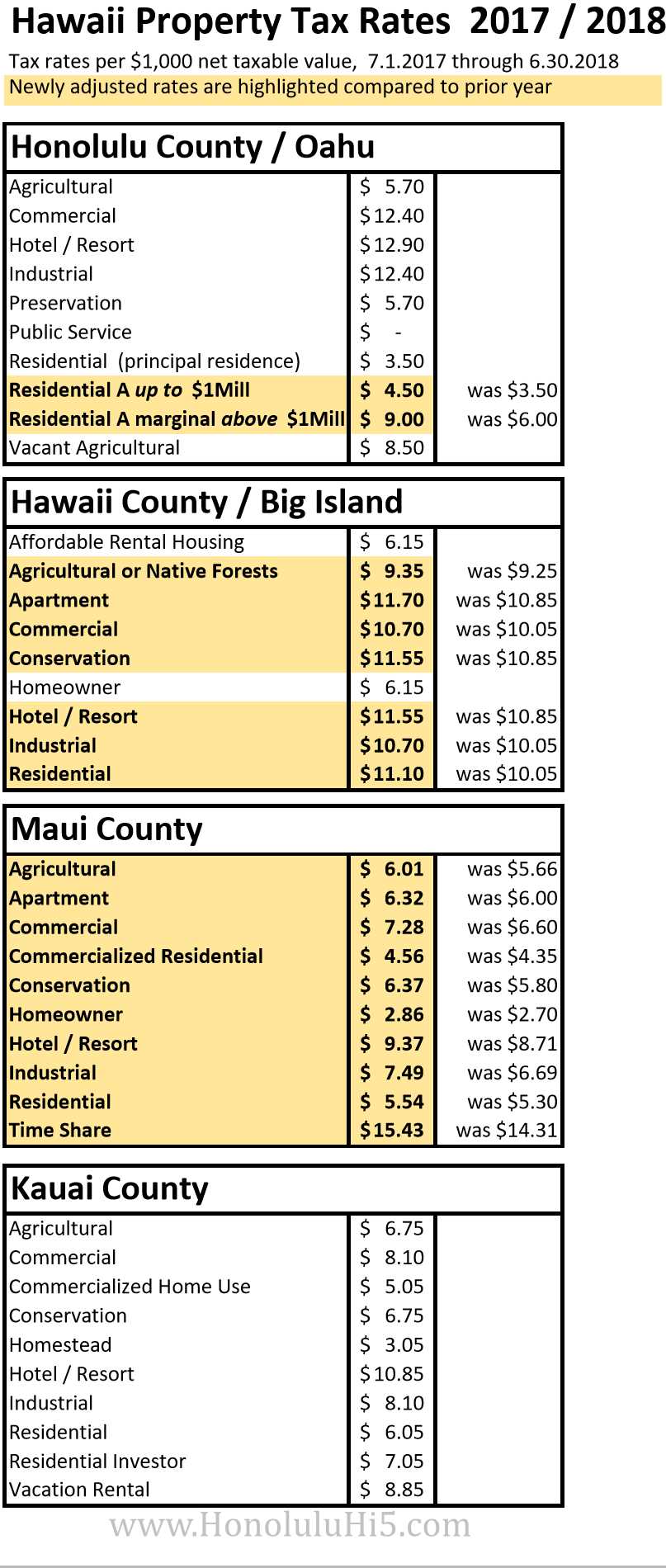

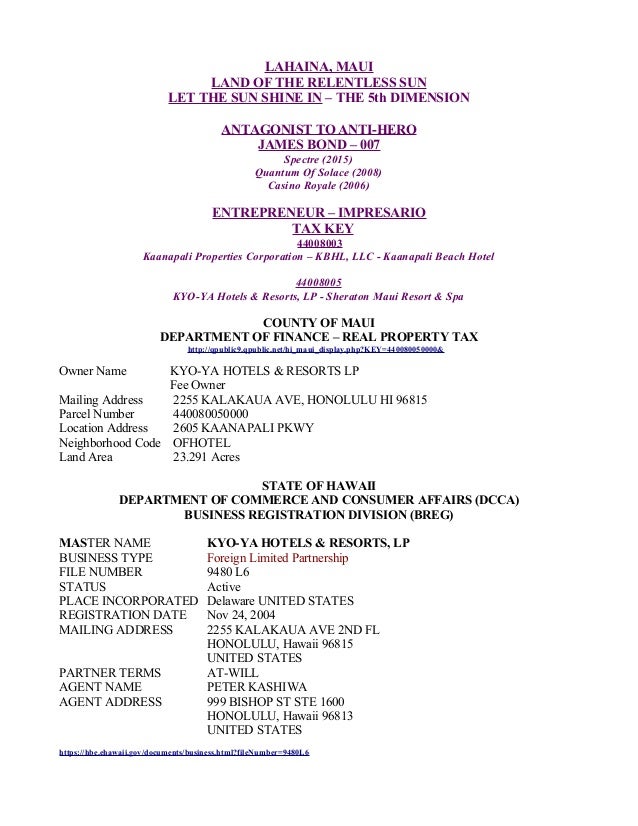

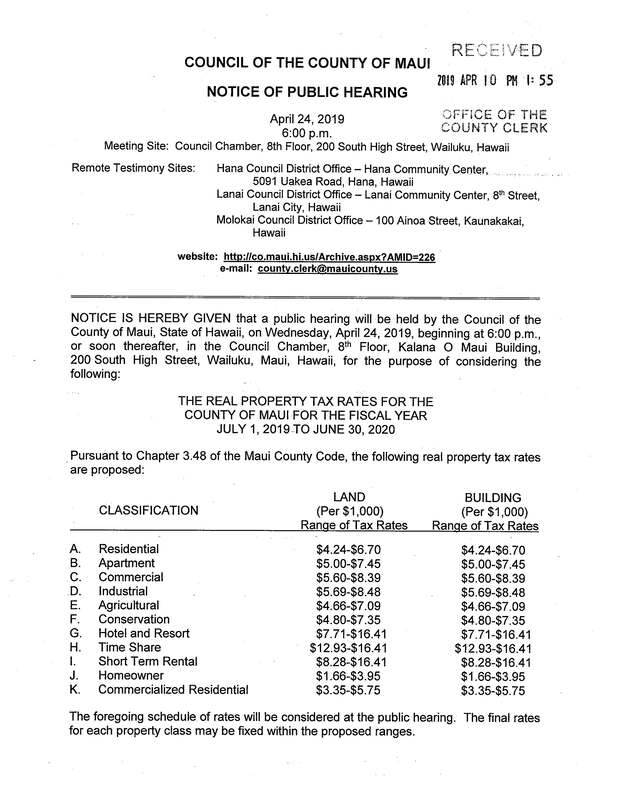

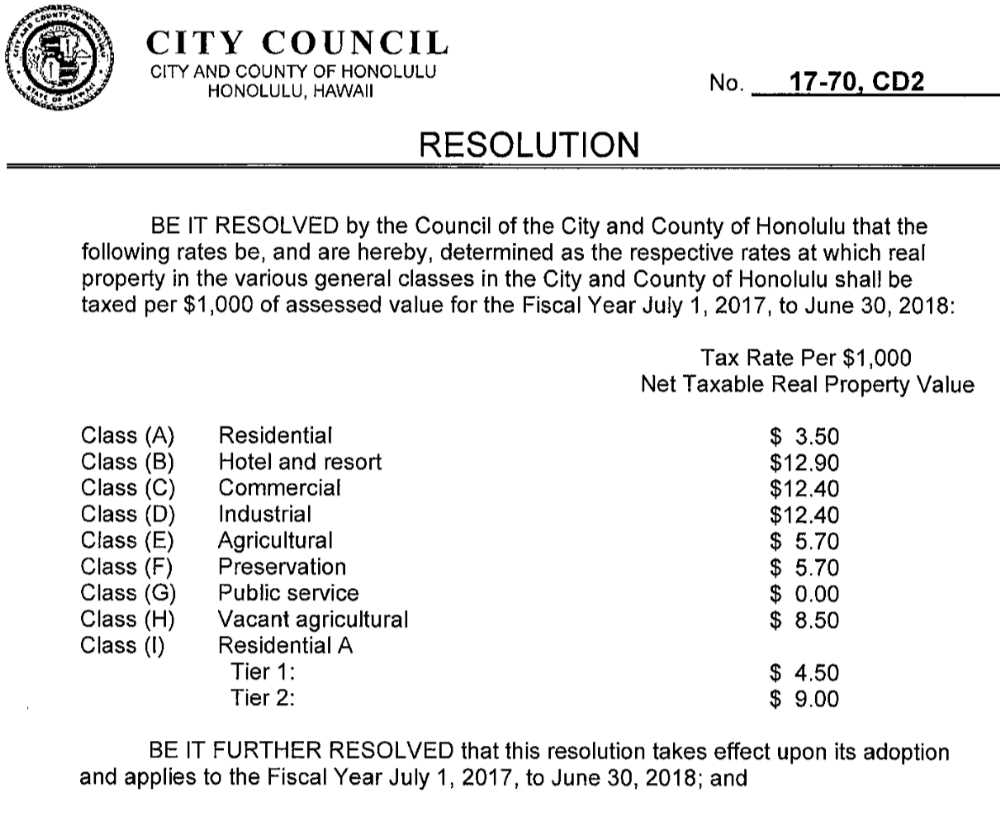

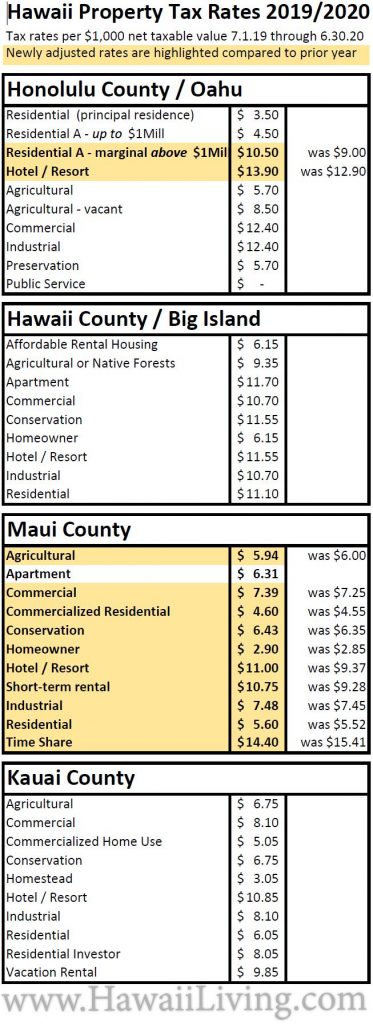

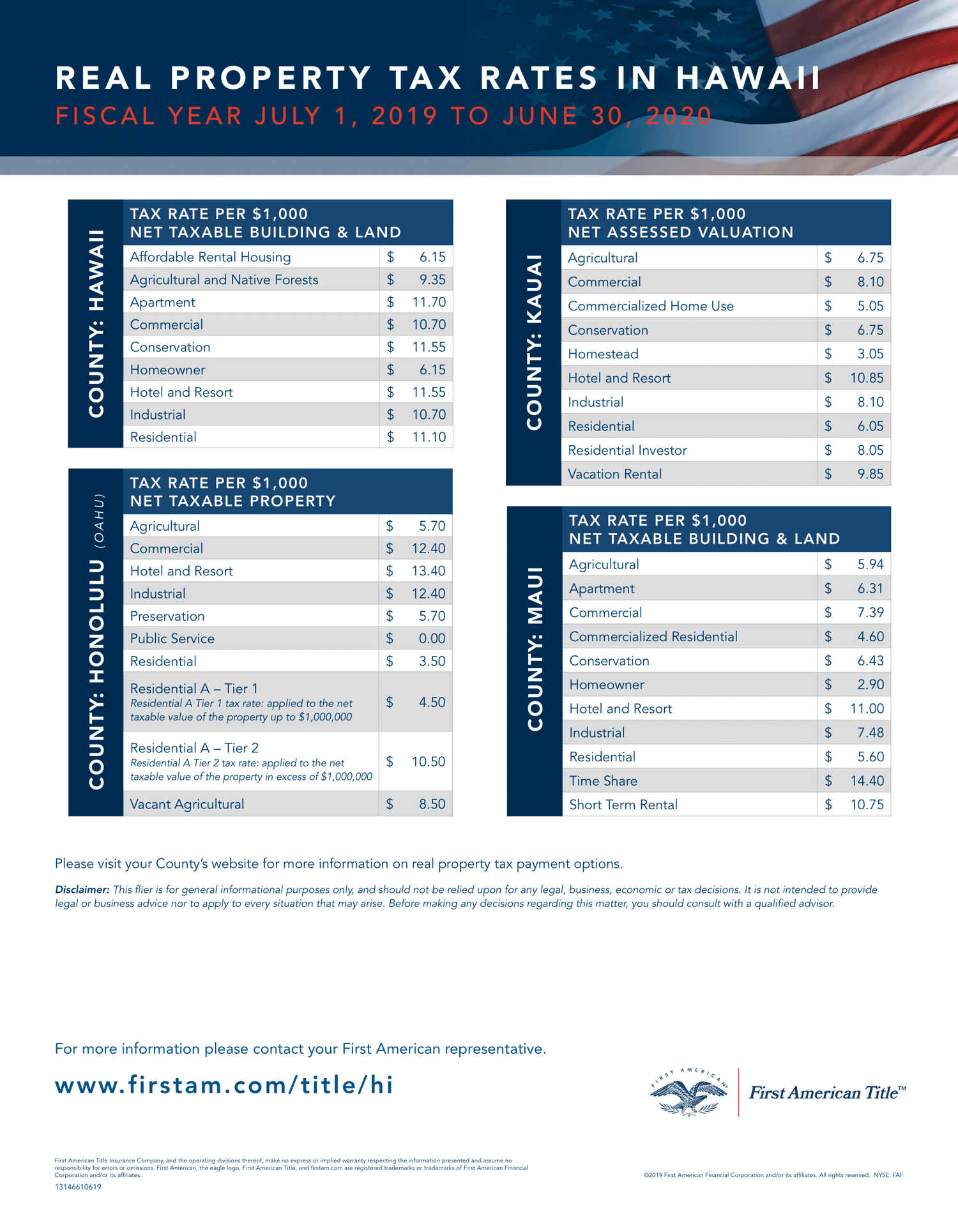

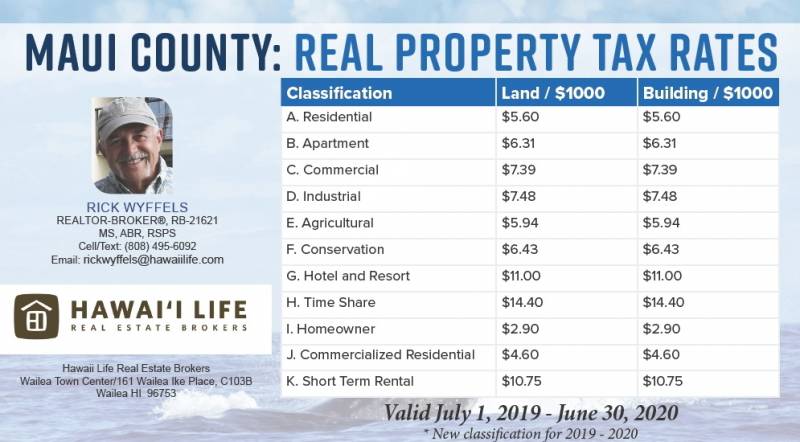

Property tax hawaii maui. Real property tax assessment website. Commercial 629 for all three tiers. The division maintains tax map keys tmk and the geographic information system gis parcel layer.

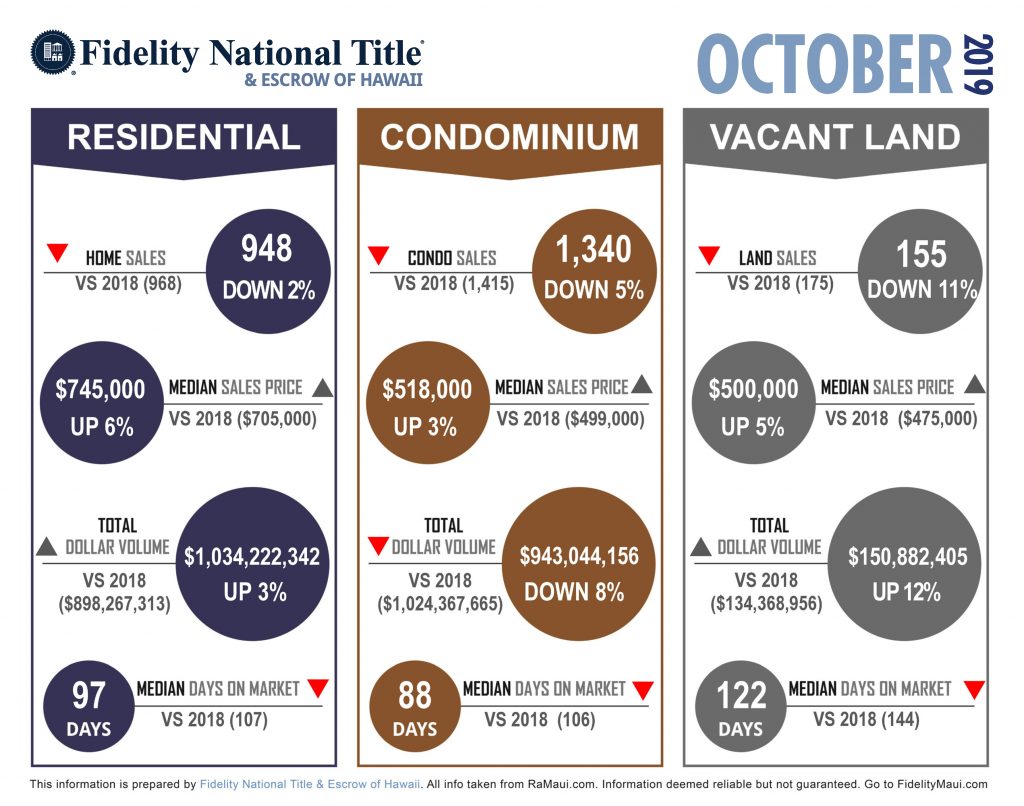

545 for tier 1 up to 800000 605 for tier 2 800001 to 1500000 690 for tier 3 more than 1500000. The county of maui real property assessment division makes every possible effort to produce and publish the most current and accurate information available. The real property assessment division administers the discovery listing and valuation of all real property in the county of maui for real property tax purposes.

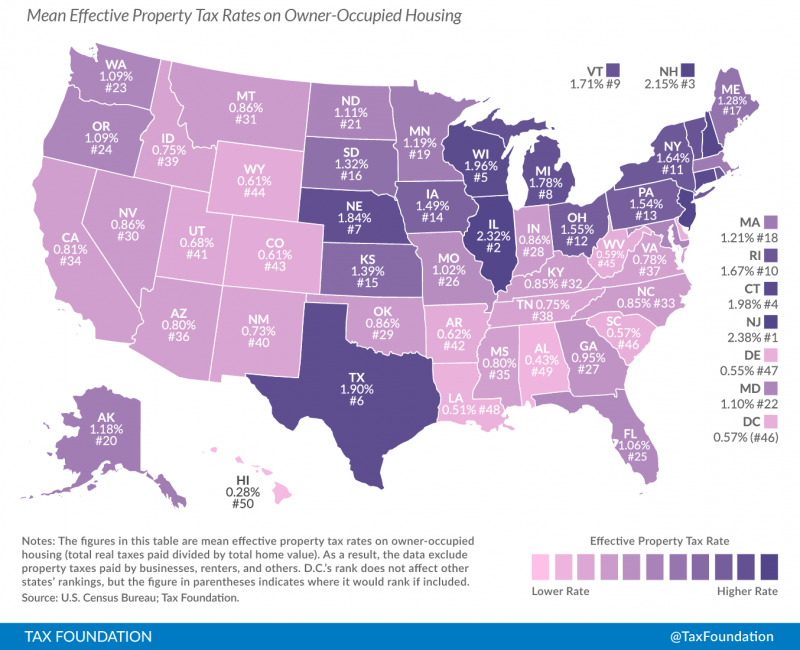

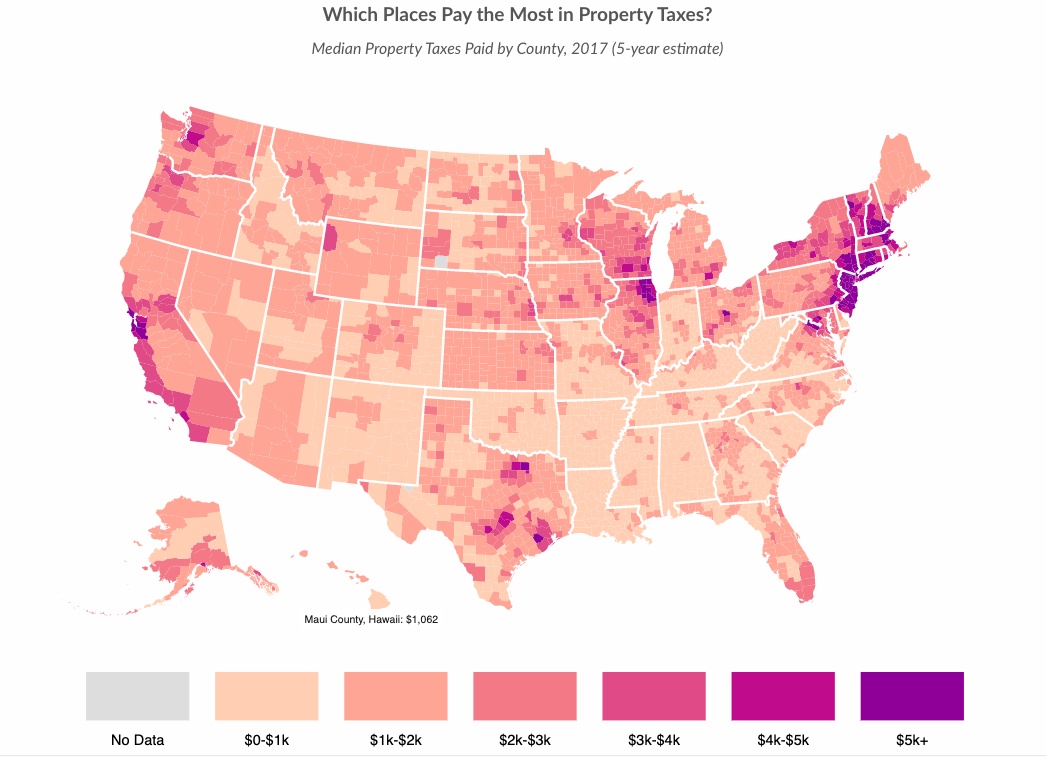

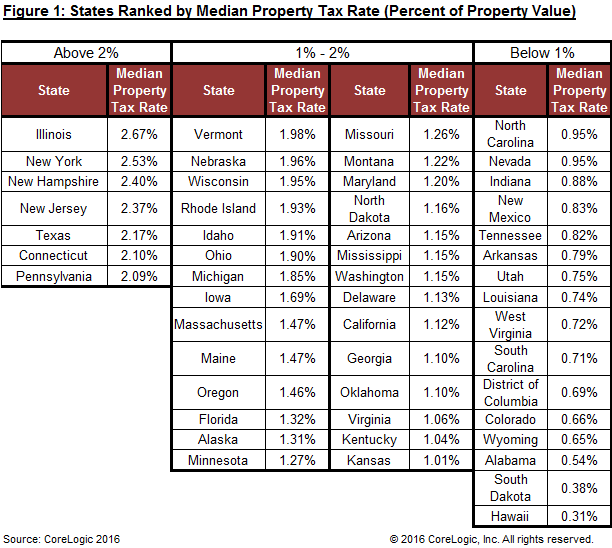

The median property tax in maui county hawaii is 965 per year for a home worth the median value of 614600. Hawaii is ranked 1539th of the 3143 counties in the united states in order of the median amount of property taxes collected. We assist the real property board of review in processing appeals.

If the property has an assessed value of 650000 then the taxes would be 650 x 290 188500 per year payable twice per year. Maui county collects on average 016 of a propertys assessed fair market value as property tax.